All Categories

Featured

Table of Contents

- – High-Value Investment Platforms For Accredited...

- – Specialist High Yield Investment Opportunities...

- – Unparalleled Accredited Investor Passive Inco...

- – Exceptional Accredited Investor Real Estate I...

- – Premium Accredited Investor Investment Funds

- – Venture Capital For Accredited Investors

- – Real Estate Investments For Accredited Inves...

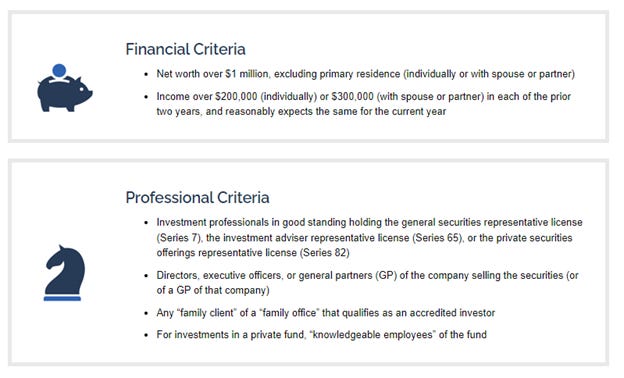

The policies for certified investors vary among jurisdictions. In the U.S, the meaning of an accredited investor is put forth by the SEC in Guideline 501 of Regulation D. To be a certified capitalist, an individual needs to have a yearly earnings surpassing $200,000 ($300,000 for joint income) for the last two years with the assumption of making the same or a greater income in the present year.

A recognized investor needs to have a web worth going beyond $1 million, either individually or jointly with a partner. This amount can not include a primary house. The SEC likewise thinks about candidates to be recognized investors if they are basic companions, executive policemans, or supervisors of a firm that is releasing non listed safeties.

High-Value Investment Platforms For Accredited Investors

If an entity consists of equity proprietors who are approved investors, the entity itself is a certified financier. However, an organization can not be created with the single purpose of purchasing certain safety and securities - accredited investor alternative asset investments. A person can qualify as an approved investor by showing adequate education or task experience in the monetary market

People that wish to be recognized financiers do not relate to the SEC for the designation. Rather, it is the obligation of the business supplying a private placement to ensure that all of those come close to are accredited investors. Individuals or parties that intend to be approved investors can approach the issuer of the non listed protections.

Intend there is a specific whose income was $150,000 for the last three years. They reported a key house value of $1 million (with a home mortgage of $200,000), a car worth $100,000 (with an outstanding loan of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Total assets is calculated as possessions minus obligations. This person's total assets is exactly $1 million. This involves a calculation of their possessions (aside from their key home) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equating to $50,000. Considering that they satisfy the internet well worth demand, they certify to be a recognized investor.

Specialist High Yield Investment Opportunities For Accredited Investors

There are a few less common certifications, such as managing a depend on with greater than $5 million in possessions. Under federal securities regulations, only those that are recognized capitalists may take part in certain protections offerings. These might include shares in exclusive positionings, structured products, and private equity or hedge funds, among others.

The regulators intend to be specific that individuals in these extremely risky and complicated financial investments can look after themselves and evaluate the risks in the lack of government defense. The certified financier rules are developed to protect prospective financiers with minimal economic knowledge from risky ventures and losses they might be unwell furnished to withstand.

Recognized investors satisfy credentials and specialist criteria to accessibility exclusive investment opportunities. Accredited investors must meet earnings and net worth requirements, unlike non-accredited people, and can invest without constraints.

Unparalleled Accredited Investor Passive Income Programs

Some essential modifications made in 2020 by the SEC consist of:. This adjustment identifies that these entity types are typically used for making investments.

These modifications broaden the certified capitalist pool by around 64 million Americans. This bigger access supplies much more chances for investors, however additionally raises potential dangers as much less financially sophisticated, capitalists can participate.

One major advantage is the chance to spend in placements and hedge funds. These financial investment alternatives are special to accredited capitalists and establishments that certify as an accredited, per SEC policies. Personal positionings make it possible for firms to secure funds without browsing the IPO treatment and regulatory documentation needed for offerings. This provides accredited capitalists the chance to invest in emerging business at a stage before they take into consideration going public.

Exceptional Accredited Investor Real Estate Investment Networks for Accredited Wealth Opportunities

They are considered as investments and are obtainable just, to certified clients. Along with known business, certified investors can pick to invest in startups and promising endeavors. This uses them tax returns and the opportunity to go into at an earlier stage and potentially gain incentives if the firm prospers.

For capitalists open to the threats involved, backing startups can lead to gains (high yield investment opportunities for accredited investors). Most of today's technology firms such as Facebook, Uber and Airbnb came from as early-stage startups supported by certified angel investors. Advanced financiers have the chance to explore investment choices that might yield more revenues than what public markets supply

Premium Accredited Investor Investment Funds

Although returns are not ensured, diversity and profile improvement choices are broadened for financiers. By diversifying their portfolios via these increased financial investment avenues approved investors can improve their approaches and possibly attain exceptional long-lasting returns with appropriate threat management. Skilled investors typically encounter investment options that may not be easily readily available to the general financier.

Financial investment choices and safety and securities supplied to accredited financiers generally include greater threats. Exclusive equity, venture capital and bush funds commonly focus on investing in possessions that lug danger but can be liquidated quickly for the opportunity of greater returns on those dangerous financial investments. Looking into before investing is vital these in scenarios.

Lock up periods protect against capitalists from taking out funds for more months and years on end. There is additionally much less openness and governing oversight of private funds compared to public markets. Capitalists might have a hard time to precisely value private properties. When handling threats certified capitalists require to examine any private investments and the fund supervisors involved.

Venture Capital For Accredited Investors

This modification may expand certified financier condition to a variety of individuals. Upgrading the income and property standards for rising cost of living to ensure they mirror modifications as time proceeds. The existing limits have remained static considering that 1982. Permitting companions in committed partnerships to integrate their sources for shared eligibility as recognized financiers.

Making it possible for individuals with specific specialist qualifications, such as Collection 7 or CFA, to qualify as recognized investors. Creating additional requirements such as evidence of financial literacy or successfully finishing an accredited investor test.

On the other hand, it might additionally result in seasoned financiers presuming too much threats that might not be ideal for them. Existing certified investors may face enhanced competitors for the ideal investment opportunities if the pool grows.

Real Estate Investments For Accredited Investors

Those who are currently thought about certified capitalists have to remain upgraded on any type of changes to the requirements and regulations. Services looking for accredited financiers should stay vigilant regarding these updates to ensure they are bring in the ideal audience of financiers.

Table of Contents

- – High-Value Investment Platforms For Accredited...

- – Specialist High Yield Investment Opportunities...

- – Unparalleled Accredited Investor Passive Inco...

- – Exceptional Accredited Investor Real Estate I...

- – Premium Accredited Investor Investment Funds

- – Venture Capital For Accredited Investors

- – Real Estate Investments For Accredited Inves...

Latest Posts

Government Tax Foreclosure Sale

Delinquent Sales Tax

Tax Lien Tax Deed Investing

More

Latest Posts

Government Tax Foreclosure Sale

Delinquent Sales Tax

Tax Lien Tax Deed Investing